Now in GST only one tax in all over India. For accounting under gst you have required three taxes. IGST (Integrated GST ), CGST (Central GST), SGST (State GST). These taxes are not created by default in tally so you have need to create these three taxes in tally Ledger.

Create IGST, CGST and SGST ledger in tally for GST.

1. IGST (Integrated Good ans Service Tax)

To create a IGST open your company go to Gateway of tally then go to account info > Ledger and create –

1. Type name IGST

2. Select under Duties & Taxes

3. Type of duty tax GST

4. Tax type select Integrated Tax

5. Y to accept and save.

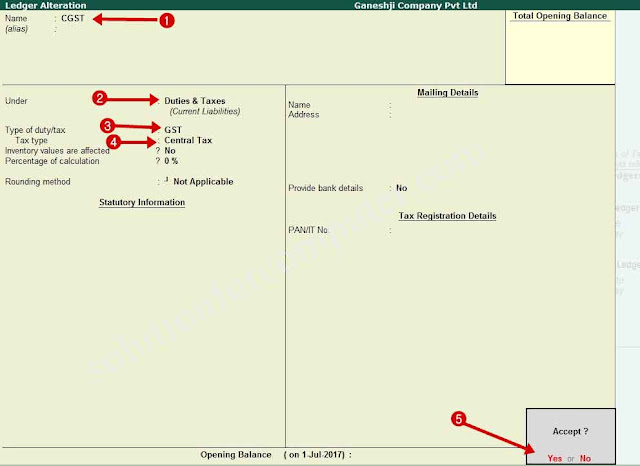

2. CGST (Central Goods & Service Tax)

To create a CGST open your company go to Gateway of tally then go to account info > Ledger and create –

1. Type name CGST

2. Select under Duties & Taxes

3. Type of duty tax GST

4. Tax type select Central Tax

5. Y to accept and save.

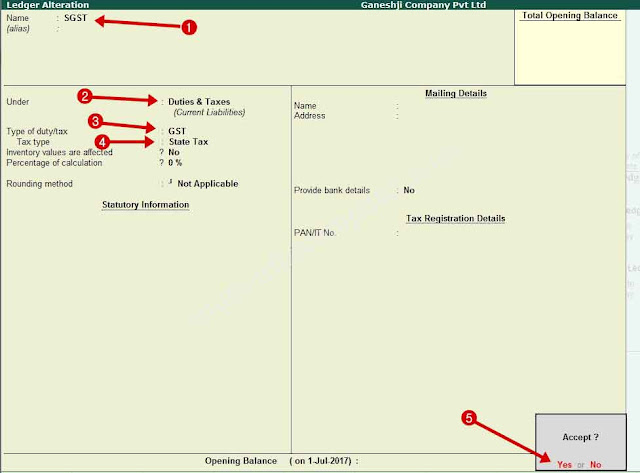

3. SGST (State Goods & Service Tax)

To create a SGST open your company go to Gateway of tally then go to account info > Ledger and create –

1. Type name SGST

2. Select under Duties & Taxes

3. Type of duty tax GST

4. Tax type select State Tax

5. Y to accept and save.

Now you have successfully create all tax ledger in tally. if you want to create cess tax then do same process only select Cess in tax type.

nice